European Political Instability and Fintech Consolidation

- Dec 22, 2025

- 1 min read

European political instability is no longer just a macro headline, it is actively reshaping fintech valuations, VC strategies, and exit routes.

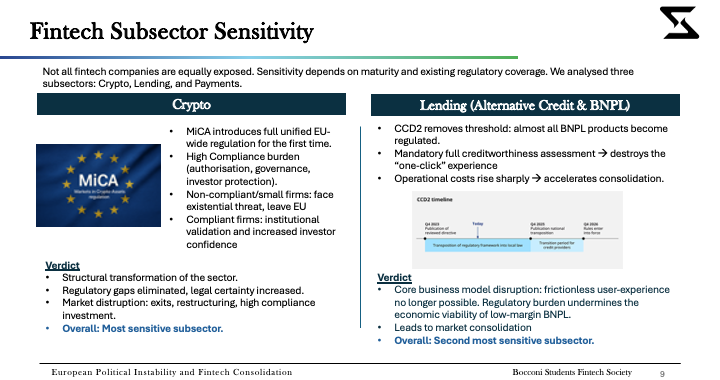

In this presentation, we analyze how regulatory uncertainty, higher interest rates, and geopolitical fragmentation across Europe are accelerating fintech consolidation, pushing investors toward compliance-ready models and making M&A the dominant exit path.

From MiCA and DORA to Brexit and the French political crisis, the data shows a clear shift: scale, resilience, and regulatory maturity are becoming survival factors rather than competitive advantages.

Slide Deck

Read the Slide Deck below ⬇️

Download the Slide Deck below ⬇️

Published in December 2025

Project Team

Project Leader: Alexandra Minca

Junior Analysts: David Musat, Clara Carlhammar, Rudolf Hozmann, Enoch Tai, and Christian Bengelsdorff.

Association Board :

Guillaume Abaz (President), Andrea Botero (Head of M&A and VC), Roxane Midorge (Head of Generalist), Neil Maaouni (Head of Data Analysis), Mathilde Castaigne (Head of Events), Noé Wierzba (Head of Operations).

Comments